What makes Froda’s business loan different?

Froda offers a fully digital business loan designed to meet the needs of small and medium-sized businesses. By digitizing the process, we save time, money, and energy for entrepreneurs in need of financing. With our business loan, you can avoid all the complicated paperwork, time-consuming meetings, and manual assessments. Instead, you can apply whenever and wherever you want, you get a fair and objective assessment of your revenue, and you get access to affordable financing when you need it.

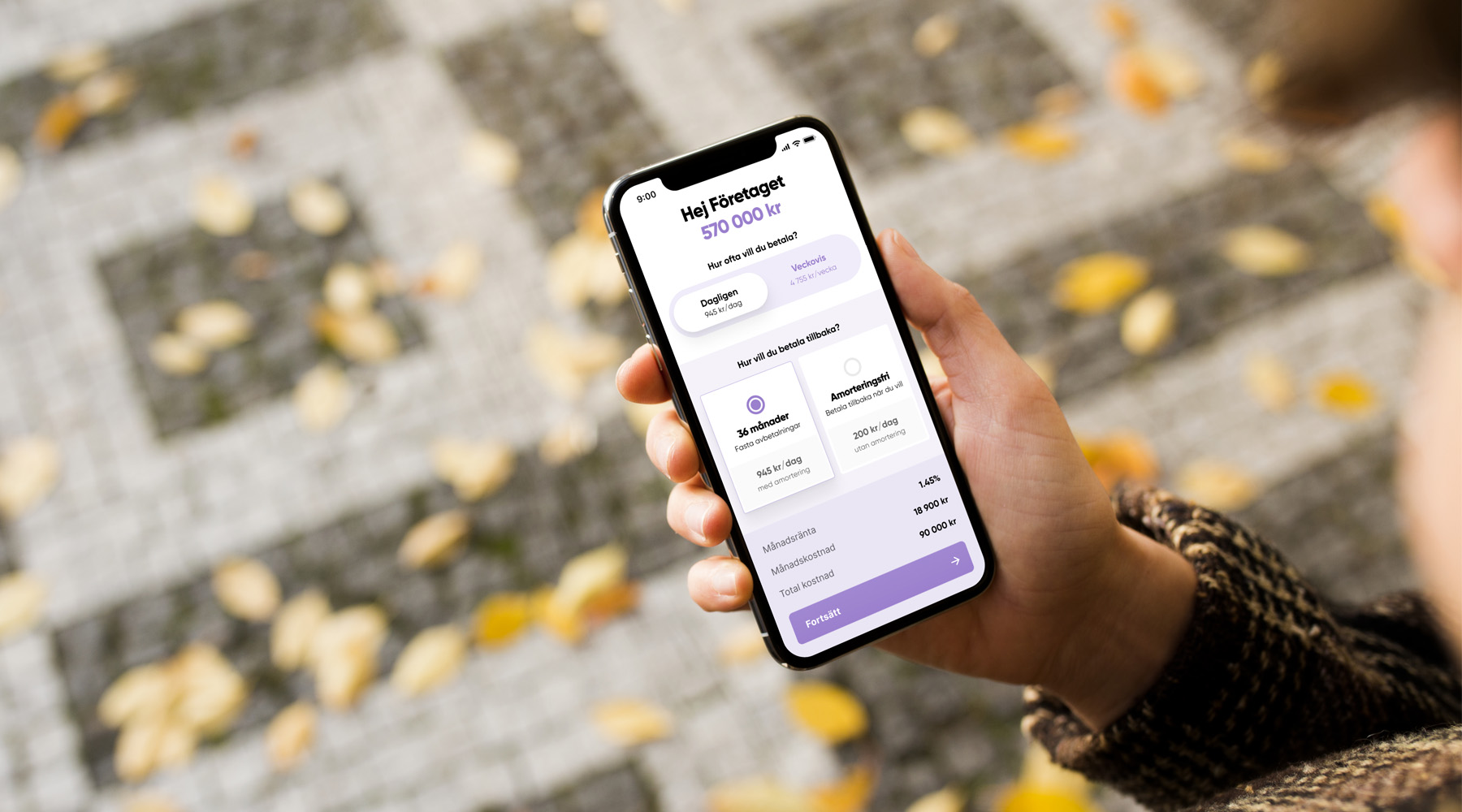

When you get a business loan at Froda, you can easily adjust the amortization and repayment to suit the needs of your business. You can also be confident that you will know the actual cost of the loan when choosing Froda. We do not charge any setup fees, and we don’t have any hidden fees or reminder fees. The interest rate is the only cost for the loan and the total cost of the business loan is presented in your offer. Moreover, our business loans do not have any binding period. So if you want to repay your business loan in advance, you can easily do so at no extra cost.

Why should I take a business loan?

Most businesses need to bring in external capital at some point. It could be for purchasing inventory or equipment, investing in property, preparing for the upcoming season, or financing expansion and growth. In other cases, the funds are needed for ongoing operations. For example, to improve liquidity, cover unexpected expenses, or pay off existing debts. Regardless of the specific need, a business loan provides fast access to the financing your business requires.

How do I apply for a business loan?

At Froda, it’s easy to apply for a business loan. We don’t require any documentation or meetings to go through your application. Instead, you apply directly with your organization number on your computer or mobile device and receive a response within 24 hours. If you’re unsure about the amount your business needs, you can use our loan calculator to determine how much you can borrow before applying. Applying for a business loan at Froda is free of charge, and you’re not obligated to anything.

What’s the maximum loan amount?

Froda offers business loans up to 15 million SEK. The exact amount your business can receive is influenced by various factors, such as your revenue and creditworthiness. It’s possible that you may be granted a loan amount that is different from what you initially applied for.

Do I need a specific type of business entity?

No. We provide business loans to all types of businesses, regardless of their size or legal form. Whether you operate your business as a limited company, limited partnership or sole proprietorship, you can turn to us when you need financing. The only requirement we have is that the business is registered in Sweden.

What interest rates does Froda offer on business loans?

The interest rate you receive on your business loan is individual and determined based on several factors. We always strive to offer the best possible interest rates on business loans to all our customers. The factors that can influence the interest rate you receive include the loan’s duration, your company’s creditworthiness, and the loan amount in relation to your company’s turnover.

What types of amortization does Froda offer?

We offer two different types of amortization on our business loans: an amortizing business loan and a non-amortizing business loan. You can choose the option that best suits your business. If you choose non-amortizing, you amortize the loan when it suits you, and you determine the size of the amortization. After one year, we evaluate whether your non-amortizing period can be extended or if your business loan should transition to become amortizing. Our regular amortization option is an annuity loan where you can choose between daily and weekly amortization. Your loan is then repaid automatically via direct debit during the loan’s duration.

What is the maximum amortization period for Froda’s business loans?

You can choose an amortization period of up to 60 months when getting a business loan at Froda. The length of the amortization period will affect the interest rate you receive and, therefore, the total cost of the loan. The specific amortization period we offer for your business is individual and can be influenced, for example, by your business’s creditworthiness.

How do you assess my application?

When applying for a business loan at Froda, you don’t need to provide a budget, business plan, or description of operations. Instead, we assess your application by reviewing your business’s transaction data through your business’s bank account. As a complement to the transaction data, we also conduct a credit check on your business, which we use in the assessment. By analyzing your sales and creditworthiness, we can make a projection of how the business will perform in the future and, thus, make a fair assessment of its financial situation and ability to repay the loan. For larger loan amounts, we may need to have a closer dialogue with you as the business owner to understand the operations, how we can meet its needs, and find an optimal solution.

Can I make changes after getting the business loan?

Yes. You can make changes and manage everything in regards to your loan when logged in at Froda. You can pause your amortization, increase your loan amount, modify the repayment schedule, make extra payments, or pay off the entire business loan in advance. When logged in, you can also see your business’s continuously updated available loan amount, making it easier for you to plan your business’s economy and investments.

What types of collateral does Froda accept?

In most cases, if you operate a limited company, you will need to provide personal guarantees when getting a business loan from Froda. However, for larger loan amounts, we may approve other types of collateral for your business loan, such as a business mortgage or property collateral. Whether you need to provide personal guarantees or if your company can use another type of collateral is determined on an individual basis. If you operate a limited partnership or sole proprietorship, you are always personally liable for the business’s debts.

Do you perform a UC credit check when I apply?

As a general rule, Froda does not perform a UC credit check when you apply. Instead, we conduct a credit report on your business through Creditsafe. The Creditsafe credit report is based solely on the information available in Creditsafe’s databases on that particular day. The number of inquiries does not affect your rating, scoring, or future credit assessments. Since we do not perform a credit check on you as an individual, your personal creditworthiness is not affected either. However, for loan amounts larger than 5 million SEK, we perform a UC credit check on the business as a complement to the Creditsafe report.

Can I get a business loan if I have payment remarks?

Yes, you can be granted a business loan at Froda even if you have payment remarks. Previous payment remarks may result in a higher interest rate and a shorter loan term. However, we primarily focus our evaluation on your business’s current financial situation rather than its historical performance. If your business has multiple payment remarks or if we believe there is a risk that you will not be able to repay the loan, we may decline your application.

Can I consolidate my business loans at Froda?

In most cases, you can consolidate your business loans at Froda. To do so, you must have the ability to repay your previous debts from other loans in advance, and the total sum of all your loans must not exceed your available capacity. If you want to consolidate your business loans at Froda, please contact us, and we will assist you with the process.